Image

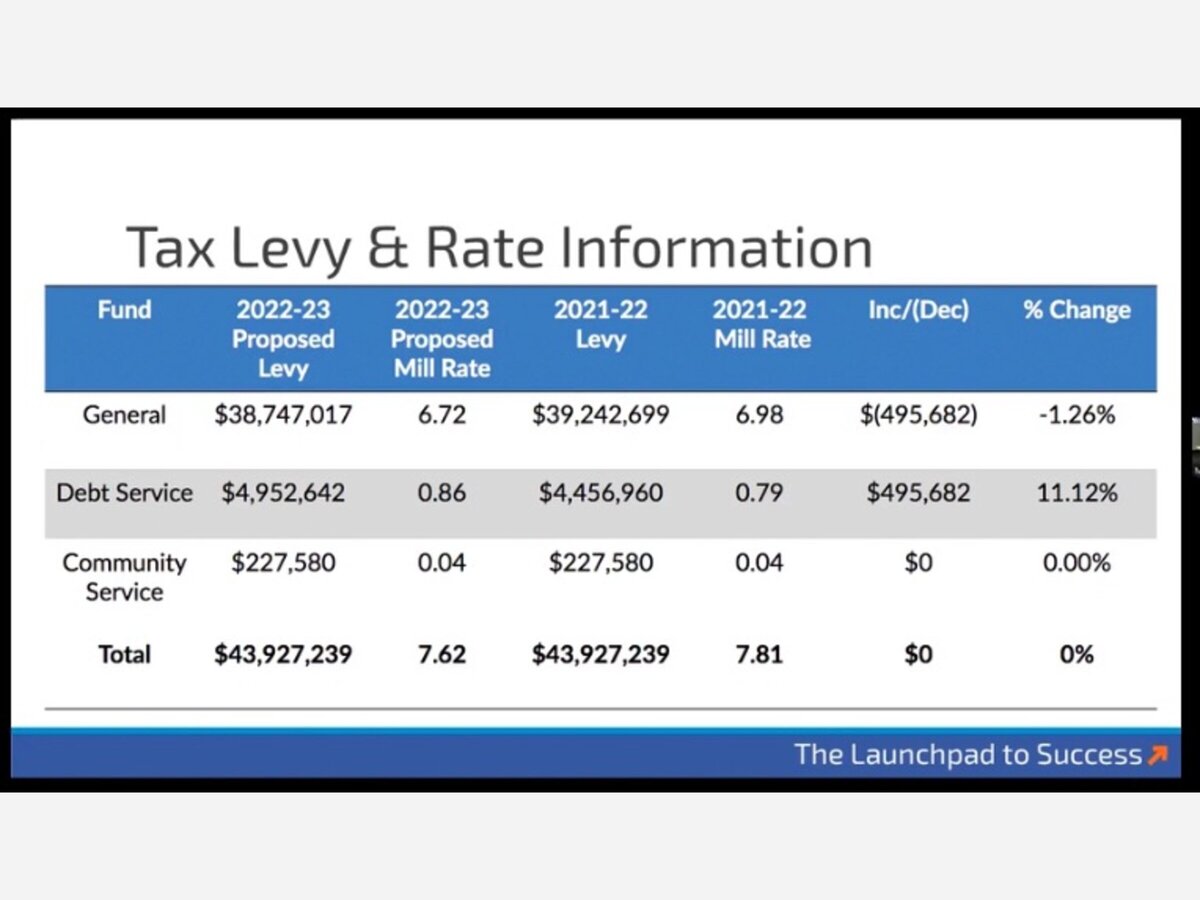

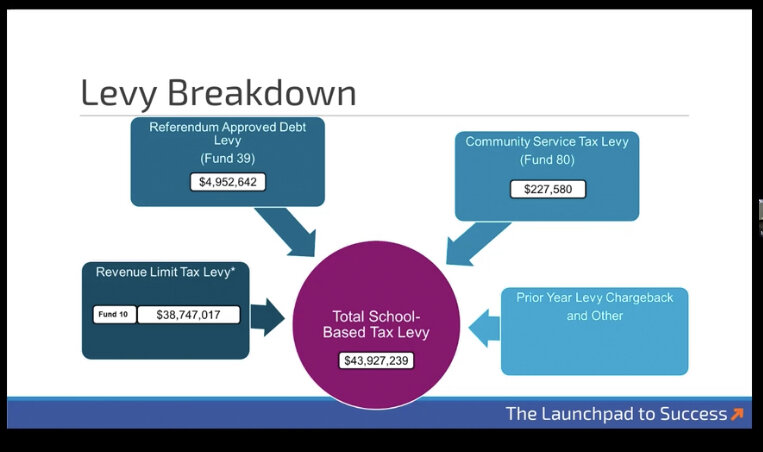

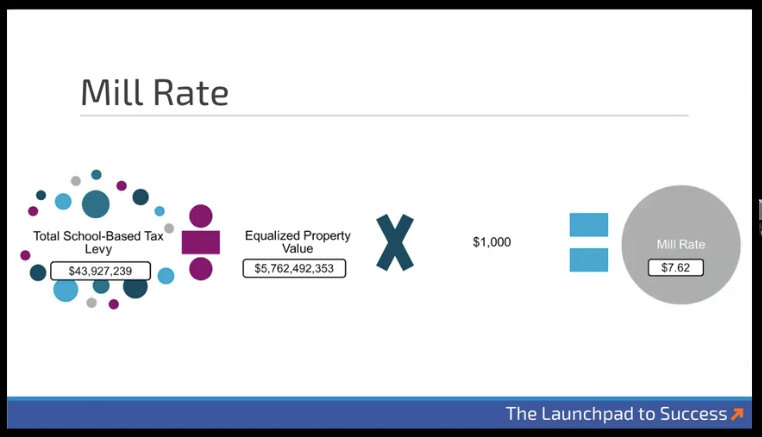

MEQUON, Wis.–Mequon-Thiensville Board of Education and resident taxpayers approved the MTSD 2022-23 annual budget this Monday for a total proposed levy of $43,927,239, which includes a 19-cent decrease in mill rate to $ 7.62 per $1,000 equalized value compared to $7.81 for the previous 2021-22 school year. A $200,000 house would approximately pay $1,524 annually. This is the maximum tax levy allowed based on current projections in state aid, state budget assumptions and student enrollment.

Rather than giving the $.19 cents back to the taxpayers, the Board of Education voted to use those accrued funds to pay down debt earlier. MTSD board member Paul Buzzell was the only no vote on the annual budget primarily because of the $.19 difference being spent to pay off debt early, which he said was a choice of the board – one that he did not support.

“The district isn’t saving money; taxpayers are saving money,” he said during discussions at a previous working board meeting where the budget was presented. “Do we tax people more today to save the taxpayers in the year 2040?”

Essentially, the tax levy will remain flat due to the allocation of the decreased mill rate of 19 cents. Buzzell said he believes the goal should be “to not tax taxpayers more than we have to, and we don’t have to,” he said. “We are just choosing to because the economics work.”

MTSD Superintendent Matthew Joynt countered that assessment saying that paying off debt early is a strategy that would help support our case for maintaining a AAA bond rating, and a AAA bond rating benefits our students, our community now.

The district has used the strategy before. In 2020, the district was able to pay off debt early saving taxpayers $1.5 million, and then after it’s amortized, it was a combined savings of $2.7 million, said board member Paula Taebel.

Debt defeasance in fund 39, the district’s debt service fund, is the district’s only mechanism to give some control over the tax levy, said Sarah Viera, MTSD’s Executive Director of Business Services.

Some ESSER funds, federal dollars given to school districts due to COVID-19, are being used to balance the 2022-23 budget. ESSER II funds amounting to $696,091 and an ESSER III allocation of $547,325 for a total of $1,243,416 are being used to offset 2022-23 existing budget expenditures. The money will focus on the Academic Recovery Plan, which addresses academic achievement and growth for each student in terms of district Milestones 1, Reading to Independent level (K-2); Milestone 2, Reading Achievement (3-8); Milestone 3, Mathematics Achievement (3-8); Milestone 4, Benchmark Attainment (9-11); and Milestone 7, Student Engagement in terms of student belonging and well-being.

Some excess ESSER funds should be available after the 2022-23 school year. Any budget adjustments will happen in October.